How to get a Finnish IP address

The easiest way to improve your digital privacy is to switch your IP address using a VPN. We’ll …

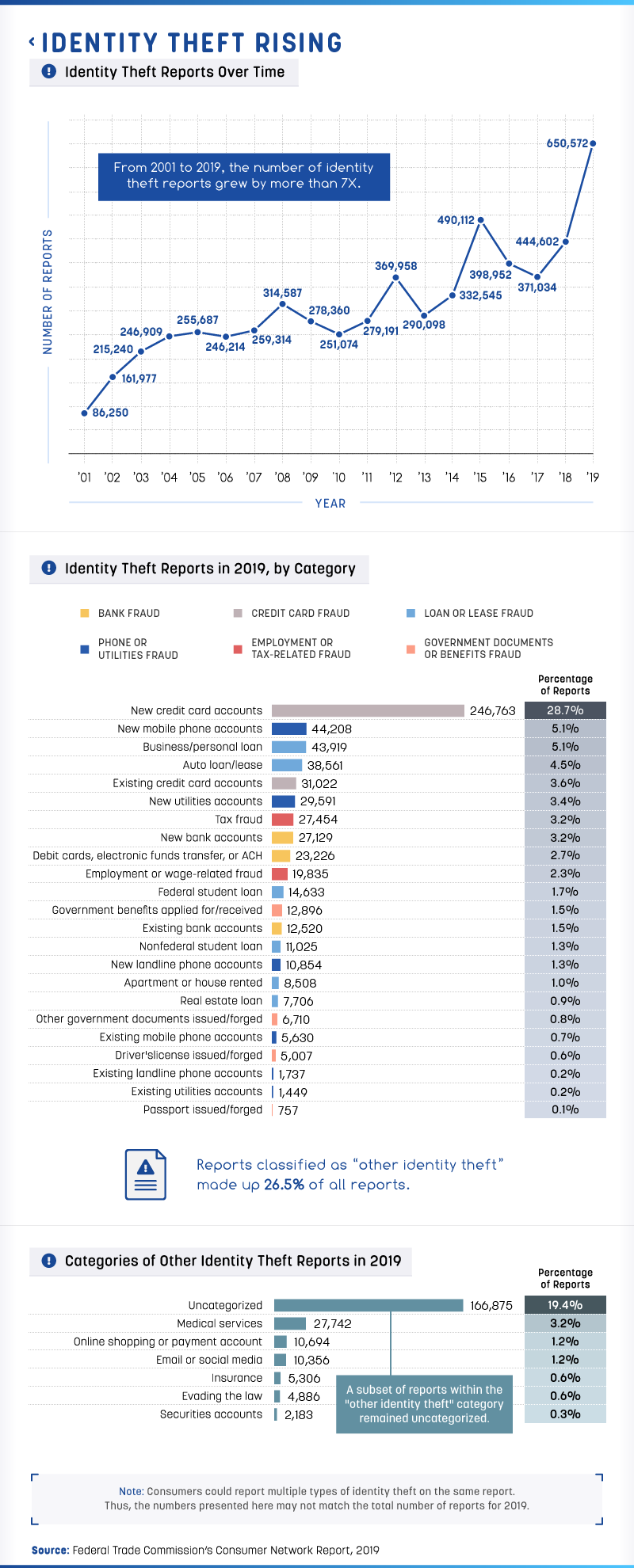

While reports of identity theft have fluctuated year to year, it continues to be a major concern citizens need to be aware of and to guard against. Keeping personal information secure and being diligent about checking bank statements are two examples of recommended practices designed to bolster security. However, it’s still possible for hackers or scammers to slip through the cracks and unleash a whirlwind of chaos.

According to the Federal Trade Commission’s Consumer Sentinel Network report’s most recent figures, there were over 600,000 cases of identity theft reported in 2019. Ranging from fake credit card signups to tax fraud, criminals are stealing identities at alarming rates and through a variety of means.

By conducting an in-depth analysis of the FTC’s 2019 report, we were able to pinpoint the areas and age demographics that deal with identity theft the most. Uncover which metropolitan areas, states, and ages are disproportionately affected in our full findings below.

The fear of stolen identity is more justified as the years go on: The number of identity theft reports in 2019 was more than seven times the number reported in 2001. Due to advancements in technology, thieves are finding more creative and innovative ways to commit identity theft, boosting the sophistication of their methods.

Significant technology launches, such as Apple Pay, make services more accessible but also open up new channels for fraud, especially for vulnerable consumers. Unfortunately, people can fall victim to more than one form of theft, so the FTC report takes into account that one instance of identity theft might fall into multiple categories. It, therefore, allows people to check off multiple types of theft in one report.

New credit card accounts were the most common type of identity theft reported, totaling over 28% of all reported cases. The next biggest segment of identity theft reports was those classified as “other identity theft.” Subtypes of this group include reports concerning medical services, online shopping, email or social media, evading the law, insurance, and securities accounts. However, over 166,000 reports in the “other identity theft” category were uncategorized.

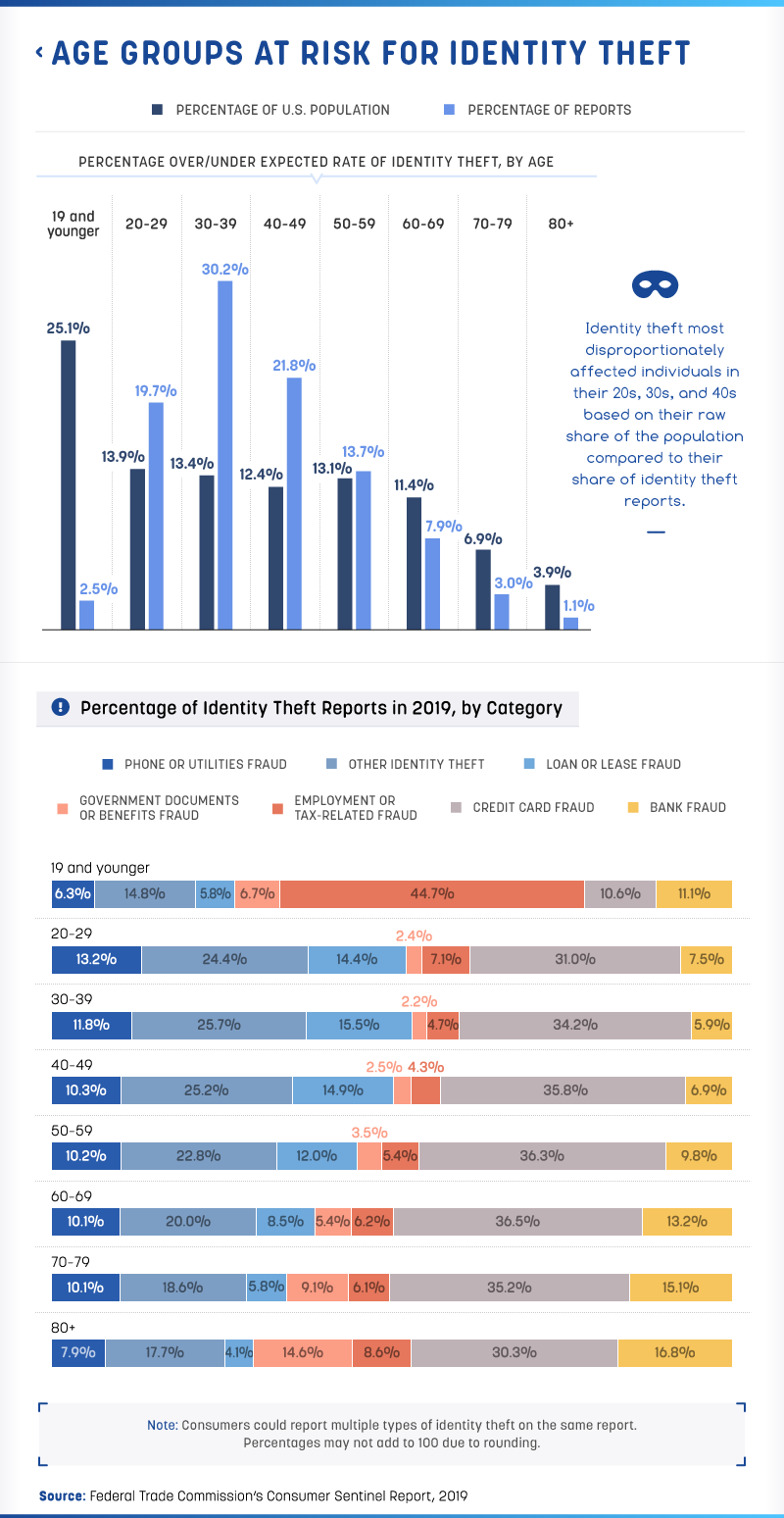

In terms of the most vulnerable populations to identity theft, Americans in their 20s, 30s, and 40s were impacted at rates disproportionate to their share of the total U.S. population. People in their 30s accounted for 30.2% of identity theft reports in 2019, despite only making up 13.4% of the total population. Mobile scams can trick even the most guarded millennials, proving that anyone can be vulnerable.

Across age groups, there were a few trends regarding identity theft categories, with older Americans having lines of credit opened in their name, and younger consumers having issues with nonverified phone or utility bills. However, for individuals age 19 and younger, workplace woes dominated cases of identity theft in 2019: Employment or tax-related fraud was the most common identity theft type among people age 19 and younger, accounting for almost half of all reports. Children are especially easy targets for identity theft, with their Social Security numbers fetching just $2 on the black market.

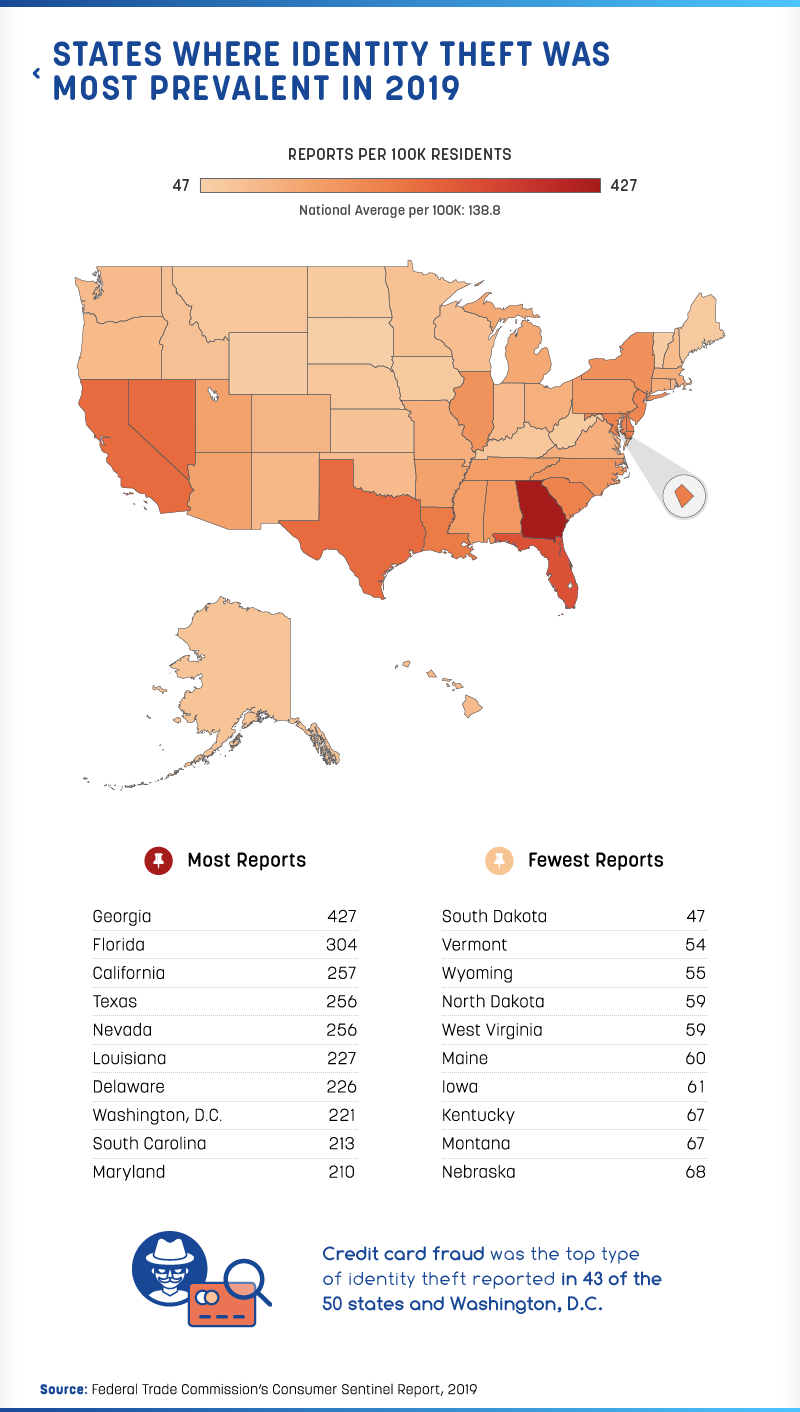

Georgia was home to the most instances of identity theft compared to its population in 2019: The Peach State had the most identity theft reports per 100,000 residents at 427. The state is home to the Atlanta-based firm Equifax, a company at the center of a massive data breach that compromised 147 million consumer identities in 2017.

Florida took the No. 2 spot with 304 cases for every 100,000 residents. Legislation was filed in the state in 2019 that would create a state task force dedicated to fighting credit card skimmers and identity fraud. If created, the task force could potentially cut down on the rate of identity theft in the state.

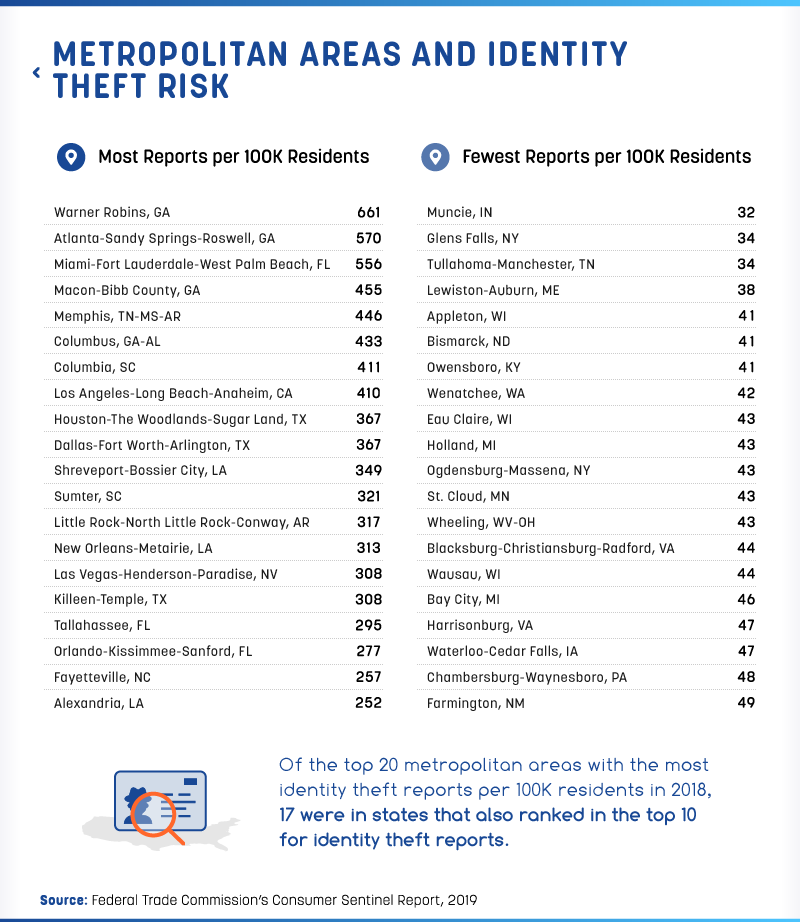

From Warner Robins metropolitan area and its nearly 192,000 residents to nearly half a million people who call Atlanta home, four of Georgia’s metropolitan areas were among those where identity theft was most prevalent in 2019. This includes Warner Robins (No. 1), with 661 cases per 100,000 residents. Residents in this area have been warned to take caution and protect themselves.

On the other hand, three Wisconsin metropolitan areas claimed the lowest rates of identity theft, including Appleton, which reported 41cases of identity theft per 100,000 residents in 2019.

As technology continues to enable thieves to steal data, the tech world should use its influence and power to stop identity theft in its tracks. However, consumers should also remain vigilant about where and how they share their information.

Be smart about how you allow your data to be used, especially when downloading apps that may have shady user agreements and little to no privacy statements. Feel safe using Hotspot Shield. Our secure, fast VPN hides your real IP address and encrypts your web traffic, giving you peace of mind that you’re safe from hackers and ISPs.

Using the Federal Trade Commission’s Consumer Sentinel Network report for 2019, we examined where identity theft is prevalent based on location and demographics, such as age. While the report includes information on fraud and other consumer reports, our analysis focused specifically on identity theft.

When looking at the types of identity theft reported in 2019, it’s important to note that people can report multiple types of theft in a report. Therefore, total numbers by identity theft type may not match the total number of reports for 2019. According to the data from the report, only 18% of reports included more than one type.

Not all identity theft reports in 2019 included the age of the victim. Our final visualization of the data looks at 87% of 2019 reports that included that information.

When comparing the percentage of reports by age group to the percentage of the U.S. population, population figures were used from here.

Metropolitan areas in the report were defined based on standards set by the Office of Management and Budget, and population estimates were based on 2018 U.S. Census figures. Metropolitan areas were ranked based on the number of reports per 100,000 population. The report did note that certain areas in the dataset were micropolitan. We excluded those from our final visualization of the data.

Data for Puerto Rico was included in the report, but we chose to exclude it from our final visualizations of the data.

The FTC Consumer Sentinel Network report is based on reports it receives from consumers about problems they experience with fraud, identity theft, and other consumer protection issues. Based on the nature of the database, it has its limitations. For example, this report, and therefore this study, only contains information on reported issues. It’s possible that issues go unreported. Therefore, this report may not match other reported figures on identity theft.

Also, as consumers fill in these reports themselves, it’s possible that information is misreported or that information was not included in the report that would be helpful.

No one wants to think about their identity being stolen, but it’s important to stay informed and know how to protect yourself. If you know someone who’d benefit from the information in this project, you’re free to share it for any noncommercial reuse. Please link back here so that people can view the entire project and review the methodology. This also gives credit to our contributors for their work.